Business

Business

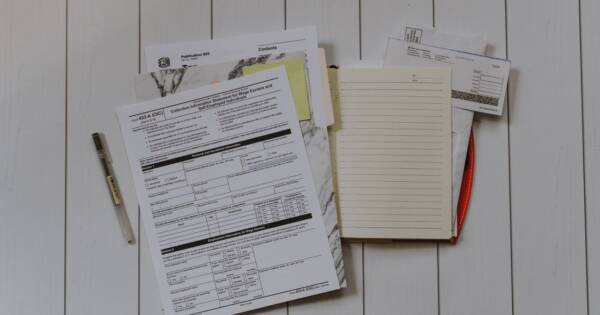

Important IRS Employment Forms and What They Mean

Learn about important IRS employment forms and what they mean, including W-4, W-9 and I-9 forms. Explore what these forms do and how they can impact hiring. The Internal Revenue Service, better known as the IRS, has a hand in many of the ways employment and income tax collection function in the United States. In […]

4 min read